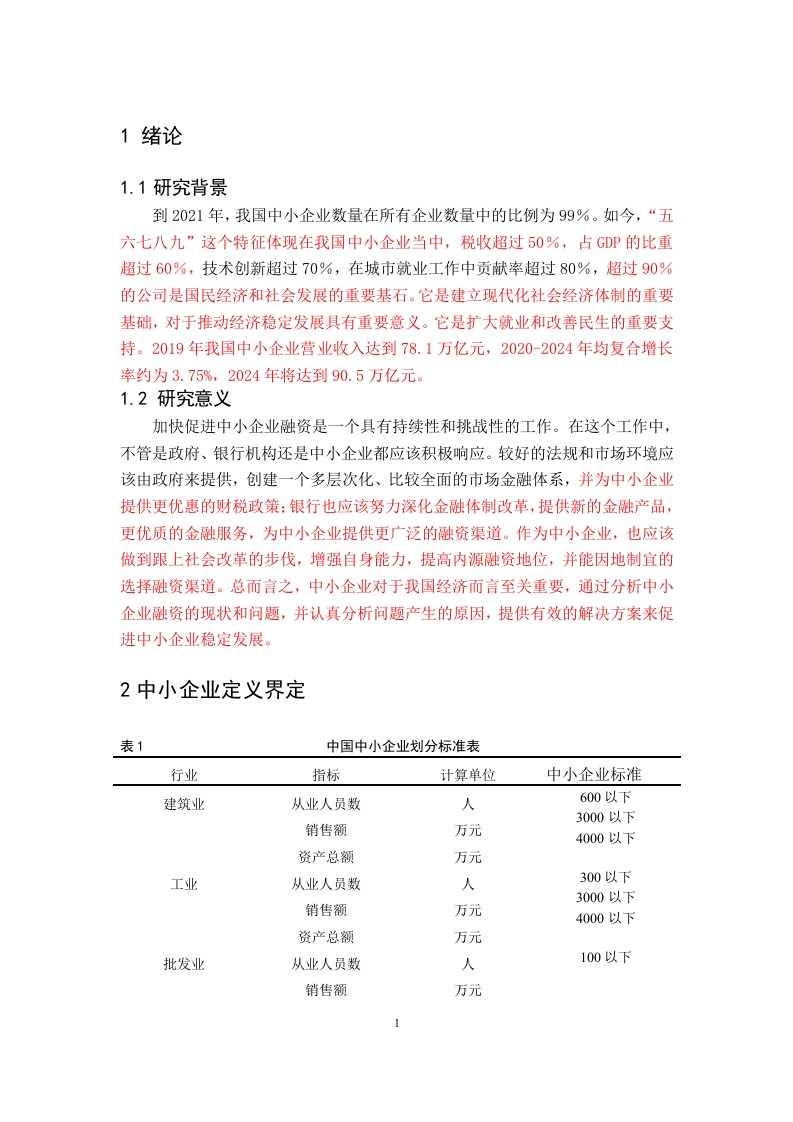

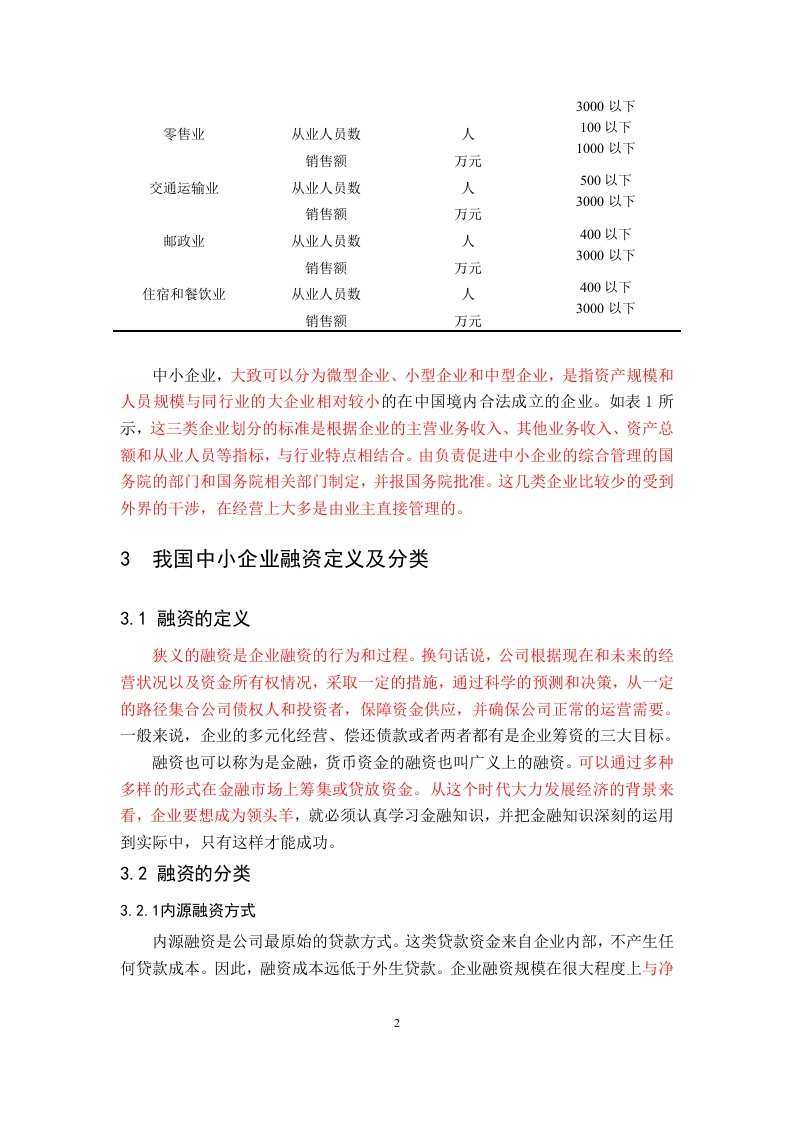

浅析中小企业融资现状分析及对策财务管理专业学生姓名指导教师摘要:中小企业在我国经济和发展中有着重要地位。它能够推动企业发展,是增强我国经济实力,并促使其健康发展的重要基石,还担任着民生和社会发展的重要战略使命。不管是在中国还是世界上的其他国家,中小企业都是必不可少的角色,当今,中国正处在改革的重要时期。随着我国经济的增长,我国中小企业的数量在逐年增加,目前占到了全国企业数量的99%。但是,在融资方面,中小企业仍然有很多的困难。与大企业相比,中小企业在技术、财力和创新等方面都处于明显的劣势。这个劣势深深影响了我国国民经济的平稳发展。本文深入分析了我国中小企业在融资方面所存在的问题,并根据问题提出了对应的解决方案。同时对融资方式提出了创新,希望实现中小企业的平稳发展和企业价值的提高。关键词:中小企业融资难相关分析Analysis on the current financing situation of smalland medium-sized enterprises and itscountermeasuresFinancial Accounting ManagementStudent name Luo Ji Supervisor Wang QiuShengAbstract:Small and medium-sized enterprises are an important pillar of China'snational economic and social development,which can promote the development ofsmall and medium-sized enterprises,is an important basis to maintain the rapid andsteady development of China's economy,but also serve as a major strategic task ofpeople's livelihood and social development.Whether in China or other countries inthe world,small and medium-sized enterprises are playing an indispensable role,today,China is in an important period of reform.In the era of encouraging massinnovation and entrepreneurship,with the growth of China's economy,the number ofsmall and medium-sized enterprises in China has been increasing year by year,accounting for 99%of the number of enterprises in the country.However,in terms offinancing,small and medium-sized enterprises still have many difficulties.Thisdifficulty has deeply affected the steady development of our national economy.Thispaper deeply analyzes the problems existing in the financing of small andmedium-sized enterprises in China,and puts forward the corresponding solutionsaccording to the problems,and puts forward the innovation of financing methods,hoping to realize the steady development of small and medium-sized enterprises andthe improvement of enterprise value.Keywords:Small and medium enterprises Financing difficulties CorrelationAnalysis目录摘要Abstract.····II1绪论,,,,11.1研究背景.112研究意义.,12中小企业定义界定13我国中小企业融资定义及分类.23.1融资的定义23.2融资的分类,24案例分析….34.1企业介绍.....…34.2公司融资背景…,34.3融资模式分析.5中小企业融资存在的问题...…35,1内部积累是中小企业重要的融资渠道35,2银行资金可靠但融资困难5.3民间借贷过高的利率限制了企业的发展5.4在企业债券融资方面融资困难..45.5在风险投资方面机会较少.55.6金融机构与中小企业之间信息不对称.6解决我国中小企业融资难的对策66.1针对内源融资难以满足资金需要,66.2针对中小企业债券融资.66.3针对风险投资..66.4解决信息不对称,缓解中小企业融资难融资贵76.5创新中小企业融资方式和融资工具..766完善中小企业融资的制度环境…87结论.8参考文献…9

暂无评论内容