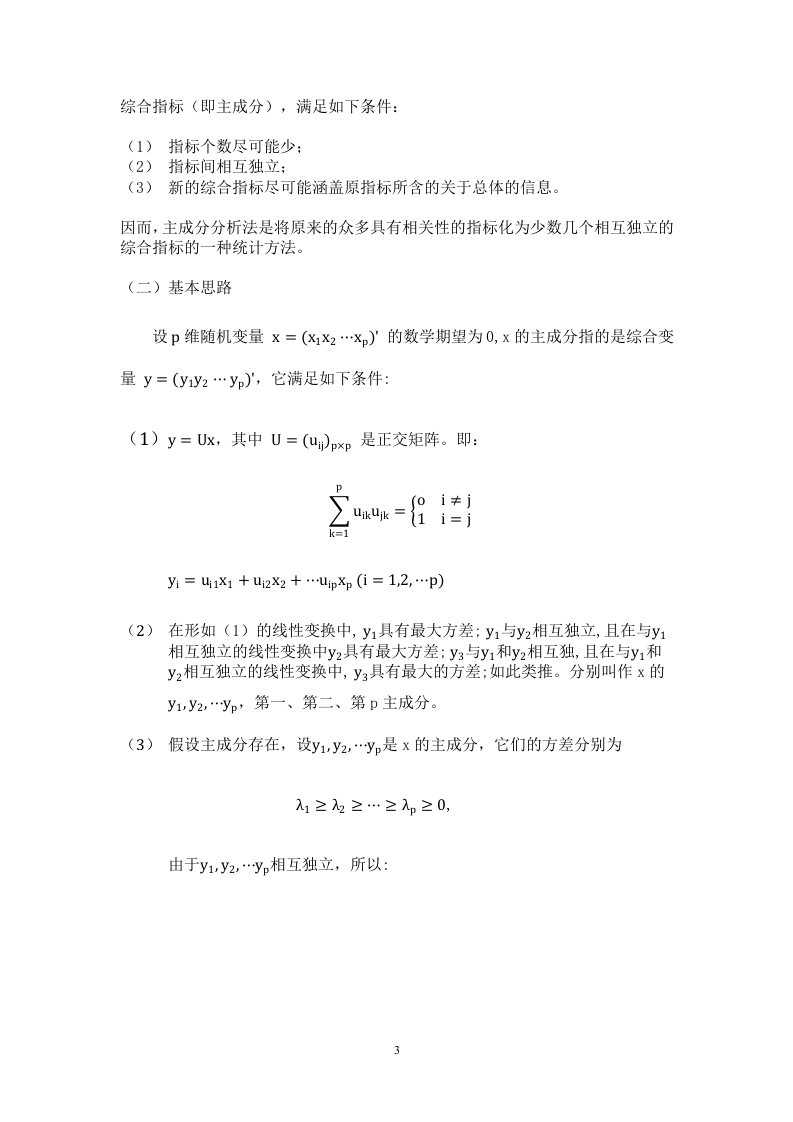

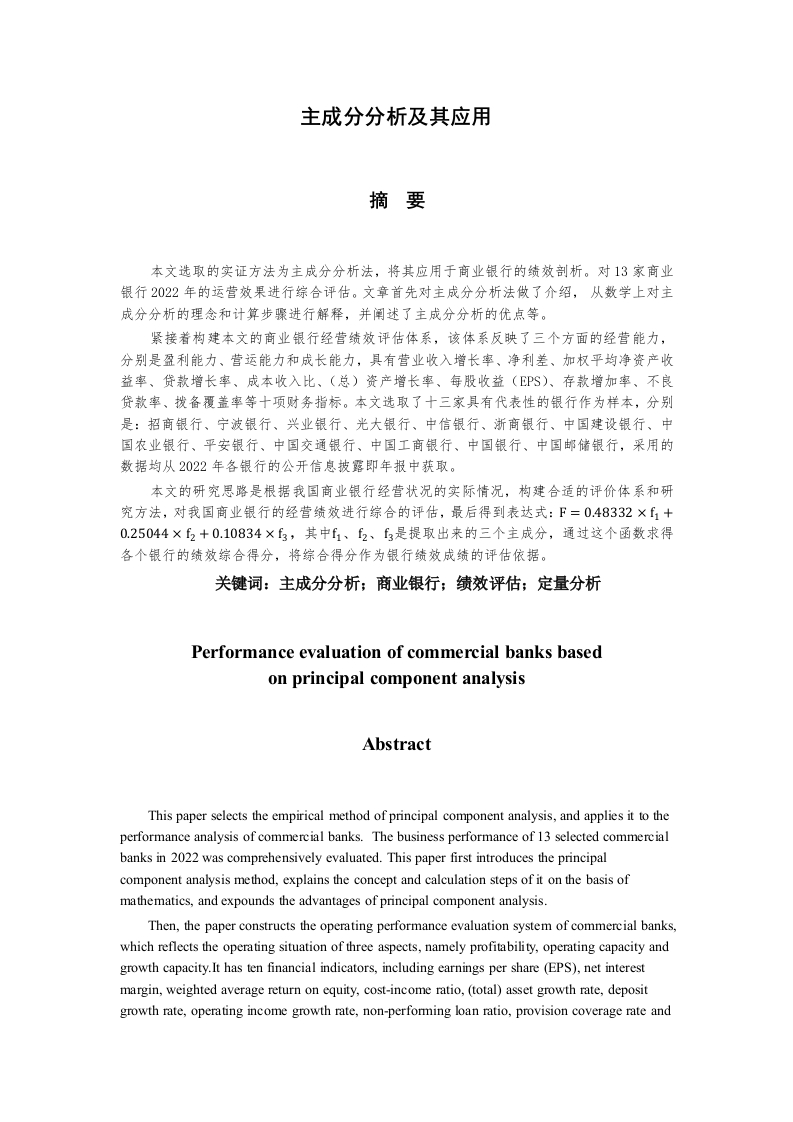

主成分分析及其应用摘要本文选取的实证方法为主成分分析法,将其应用于商业银行的绩效剖析。对13家商业银行2022年的运营效果进行综合评估。文章首先对主成分分析法做了介绍,从数学上对主成分分析的理念和计算步骤进行解释,并阐述了主成分分析的优点等。紧接着构建本文的商业银行经营绩效评估体系,该体系反映了三个方面的经营能力,分别是盈利能力、营运能力和成长能力,具有营业收入增长率、净利差、加权平均净资产收益率、贷款增长率、成本收入比、(总)资产增长率、每股收益(EPS)、存款增加率、不良贷款率、拨备覆盖率等十项财务指标。本文选取了十三家具有代表性的银行作为样本,分别是:招商银行、宁波银行、兴业银行、光大银行、中信银行、浙商银行、中国建设银行、中国农业银行、平安银行、中国交通银行、中国工商银行、中国银行、中国邮储银行,采用的数据均从2022年各银行的公开信息被露即年报中获取。本文的研究思路是根据我国商业银行经营状况的实际情况,构建合适的评价体系和研究方法,对我国商业银行的经营绩效进行综合的评估,最后得到表达式:F=0.48332×1+025044×2+0.10834×3,其中f1、2、53是提取出来的三个主成分,通过这个函数求得各个银行的绩效综合得分,将综合得分作为银行绩效成绩的评估依据。关键词:主成分分析:商业银行;绩效评估;定量分析Performance evaluation of commercial banks basedon principal component analysisAbstractThis paper selects the empirical method of principal component analysis,and applies it to theperformance analysis of commercial banks.The business performance of 13 selected commercialbanks in 2022 was comprehensively evaluated.This paper first introduces the principalcomponent analysis method,explains the concept and calculation steps of it on the basis ofmathematics,and expounds the advantages of principal component analysis.Then,the paper constructs the operating performance evaluation system of commercial banks,which reflects the operating situation of three aspects,namely profitability,operating capacity andgrowth capacity.It has ten financial indicators,including earnings per share (EPS),net interestmargin,weighted average return on equity,cost-income ratio,(total)asset growth rate,depositgrowth rate,operating income growth rate,non-performing loan ratio,provision coverage rate andloan growth rate.Thirteen representative banks are selected as samples in this paper,which are:CITIC Bank,Ping An Bank,Industrial Bank,China Merchants Bank,Everbright Bank,ZheshangBank,Bank of China.China Construction Bank.Bank of Communications of China.Industrialand Commercial Bank of China,Agricultural Bank of China,Postal Savings Bank of China andBank of Ningbo.all used data obtained from the banks'public information disclosure,or annualreport,in 2022.The research idea of this paper is based on the actual conditions of our commercial banks,using reasonable evaluation indexes and empirical analysis methods,the managementperformance of our commercial banks is evaluated objectively,and the final expression is:F0.48332 x f +0.25044 x f2 +0.10834 x f3,This expression is the bank's aggregate scorefunction,where f f2 f3 is the extracted three principal components.Through this function,wecan get the comprehensive score of each bank,from which we can see the operating performanceof each bank.Key words:principal component analysis;commercial banks;performance evaluation;quantitative analysis目录1绪论………11.1本文的选题背景与研究意义…12基于主成分分析法的商业银行绩效评估体系…………………22.1主成分分析法的相关理论介绍…22.2银行绩效评估体系的指标选择*…73基于主成分分析法的银行绩效评估的实证分析……103.1样本的选取与数据来源………………103.2数据的处理…………………………………………113.3实证分析过程……124参考文献…175致谢……18

暂无评论内容