标签

排序

基层税收风险管理问题及对策研究

山西财经大学硕士学位论文ABSTRACTTax,an important policy tool,is a main source of a country's revenue.It has greatimportance for the development of the country.In recent years,with ...

股指期货交易的税务问题研究

北京理工大学珠海学院2020届本科生毕业论文Research on tax issues of stock index futures tradingAbstractThis paper discusses the tax focus of stock index futures,according to the deve...

我国增值税减税政策效应分析

“营改增和增值税持续深入推进,增值税税收优惠对制造业产生的冲击是有意义的,并对其税收优惠的效果进行了剖析。二文献综述基于增值税改革的福利效应视角,有学者从喀麦隆出发,探讨了实行增值...

房地产企业增值税税务筹划研究

北京理工大学珠海学院2020届本科生毕业论文Research on VAT payment planning of real estate enterprisesAbstractSince the country's comprehensive policy of 'reform and increase of opera...

房地产投资与土地增值税政策分析

Analysis on Read Estate Investment and value-addedtax policyAbstractSince 1998,especially since 2003,the scale of real estate has been growing at a visible speed,and the real estat...

社保入税后中小型民营企业用工成本降低措施研究-以珠海市为例

北京理工大学珠海学院2020届本科生半业论文AbstractScientific and effective collection and management of social insurance premium canpromote the sustainable development of social insu...

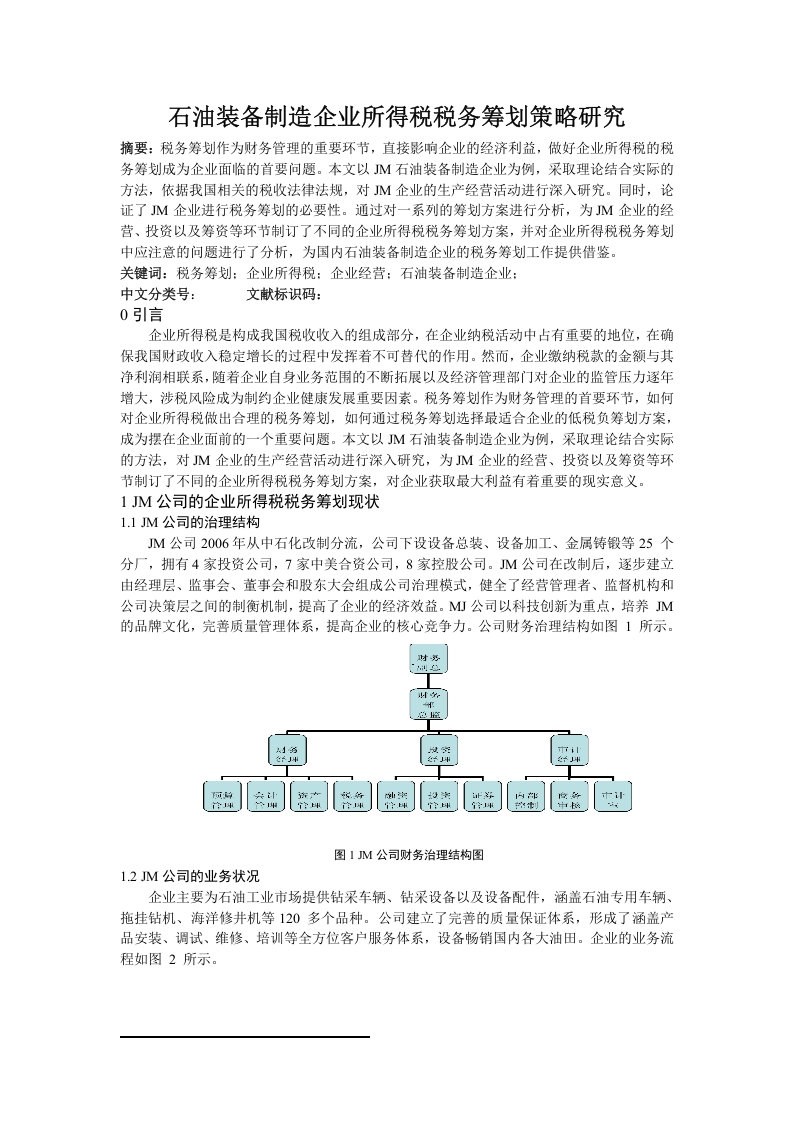

石油装备制造企业所得税税务筹划策略研究

信旦收华:研开发:斗产销仁:售后眼务:本行业会太发邻市导为容出制★山因内L后水女业调听火管理耀袋'与为尘产书巴女国外售太产品批广图2M企业的业务流程图13M公司的企业所得税管理现状虽然各...

房地产开发企业纳税筹划研究

本科论文AbstractReal estate is an important part of China's economic development.It can not onlyincrease the country's fiscal revenue,but also enable China's economic level to grow...

企业所得税纳税筹划方法在传媒企业的应用——以华谊兄弟为例

本科论文AbstractTax planning is the organization structure,production management,planning andmanagement activities,financial management and other economic operations,andeven tax is...

辽宁安尔冠润滑油有限公司合理避税方法研究

本科论文scientifically.Based on the theoretical study of reasonable tax avoidance,this paper analyzes thecurrent tax status of China's small and medium-sized enterprises by combini...